add your logo, and

automate routine tasks.

Evaluate the convenience right now!

From static documents to dynamic time management

Dynamic management:

Real-time:

Integration:

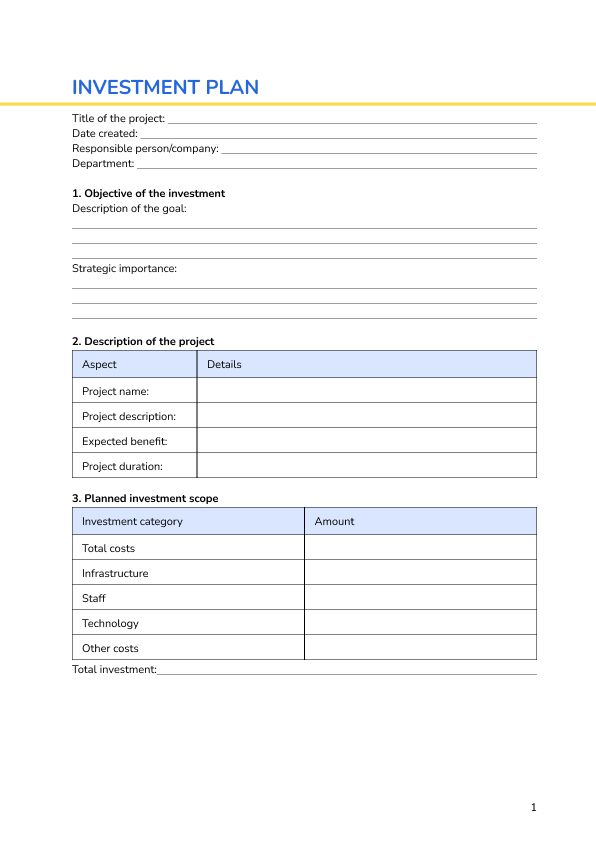

An Investment Plan is a strategic financial document that outlines the steps and methods an organization or individual will take to allocate resources towards specific investments. The purpose of the Investment Plan is to define clear goals for generating returns, managing risks, and ensuring the growth of capital. This document serves as a guideline for making informed decisions regarding capital allocation, asset management, and potential investment opportunities. The scope of an Investment Plan typically covers financial goals, asset distribution, investment types, and detailed risk management strategies, while considering factors such as market conditions, financial goals, and available resources.

Key features of the Investment Plan include an analysis of different investment vehicles, such as stocks, bonds, real estate, or alternative investments, and a timeline for achieving specific financial objectives. The Investment Plan also outlines anticipated returns, liquidity requirements, and risk tolerance, ensuring that investments align with the investor’s financial goals and risk profile. Diversification strategies, expected cash flow, and periodic assessments of the investment’s performance are integral aspects of the document. Ultimately, an Investment Plan helps individuals and organizations make calculated decisions, balance risks, and stay aligned with long-term financial strategies, ensuring sustainable growth and success.